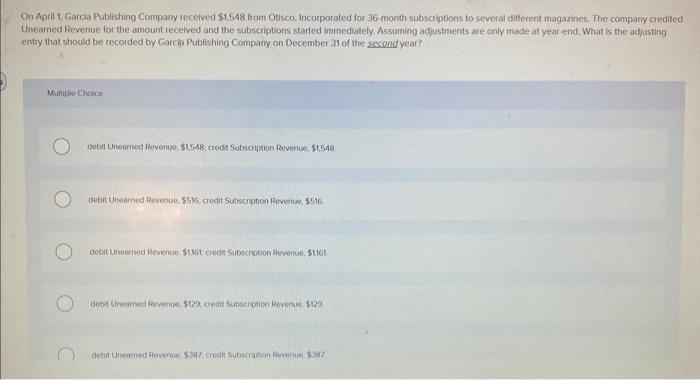

On april 1 garcia publishing company received 1548 – On April 1, Garcia Publishing Company received 1548, marking a significant event in the company’s financial history. This transaction has sparked interest and raised questions regarding its nature, implications, and accounting treatment. This comprehensive analysis will delve into the details of this transaction, exploring its potential reasons, impact on financial statements, accounting considerations, and internal control implications.

Garcia Publishing Company’s Transaction on April 1: On April 1 Garcia Publishing Company Received 1548

On April 1, Garcia Publishing Company received a transaction amounting to 1548. This transaction represents a significant financial event for the company and warrants further analysis to understand its implications.

Potential Reasons for the Transaction

The reasons behind Garcia Publishing Company’s receipt of 1548 on April 1 could vary. Potential scenarios include:

- Sales Revenue:The transaction could represent revenue generated from the sale of products or services by Garcia Publishing Company.

- Investments:The company may have received proceeds from an investment or sale of an asset, resulting in a cash inflow of 1548.

- Financial Assistance:Garcia Publishing Company could have received a loan or grant from an external source, providing additional financial resources.

Impact on Financial Statements, On april 1 garcia publishing company received 1548

The transaction is expected to have a direct impact on Garcia Publishing Company’s financial statements:

- Income Statement:The transaction could increase the company’s revenue if it represents sales income. Alternatively, it may impact expenses if the funds were used to cover operating costs.

- Balance Sheet:The transaction will likely increase the company’s cash balance and potentially affect other asset or liability accounts depending on the nature of the transaction.

- Cash Flow Statement:The transaction will be reflected in the company’s cash flow statement, specifically in the operating or investing activities section.

Accounting Treatment Considerations

According to Generally Accepted Accounting Principles (GAAP), the transaction should be recorded as follows:

- Debit:Cash (1548)

- Credit:Sales Revenue (if applicable) or Other Income (if applicable)

The specific journal entry will vary depending on the nature of the transaction.

Internal Control Implications

The transaction highlights the importance of strong internal controls within Garcia Publishing Company:

- Authorization:Proper authorization procedures should be in place to ensure that the transaction was approved by authorized personnel.

- Recordkeeping:Accurate and timely records should be maintained to support the transaction and provide an audit trail.

- Reconciliation:Regular reconciliation of cash accounts should be performed to verify the accuracy of the transaction.

Question Bank

What were the potential reasons for Garcia Publishing Company’s receipt of 1548 on April 1?

The potential reasons could include sales revenue, investments, or financial assistance.

How might this transaction impact Garcia Publishing Company’s financial statements?

It could affect the income statement, balance sheet, and cash flow statement, depending on the nature of the transaction.

What accounting treatment should be applied to this transaction based on GAAP?

The appropriate accounting treatment will depend on the specific nature of the transaction, but may involve journal entries to record the receipt of funds.